If you look beyond the unemployment figures you will see that underemployment is the insidious burden on our economy. You will see families who are counted as success stories by the Bureau of Labor Statistics, but who are unable to pump fuel in the economic engine that drives our economy.

If you look beyond the unemployment figures you will see that underemployment is the insidious burden on our economy. You will see families who are counted as success stories by the Bureau of Labor Statistics, but who are unable to pump fuel in the economic engine that drives our economy.

– – – – –

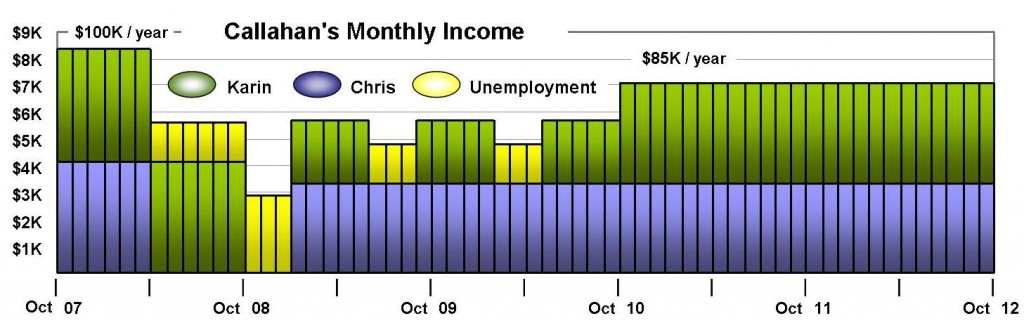

On 1 October 2007, Chris and Karin Callahan* were earning $100K per year. Along with their three kids – two in elementary and one in middle school – they were living their version of the American Dream.

Six months later Chris was laid off from his $50K job as a production manager. He found a new job as a production supervisor nine months later. He’s held this $40K job for the past 45 months.

Karin kept her $50K job as a financial analyst until 30 September 2008. In the next two years she scraped and scrapped and worked a series of temporary jobs for a total of 15 out of those 24 months. Each job paid $14 per hour, which is $28K annualized. Two years ago she landed a good job as an accounting specialist and now earns $45K annually.

For the past two-plus years Chris and Karin have been fully employed. They do not appear anywhere on the Bureau of Labor Statics’ radar screen. Even though they are earning 85% of what they used to make in the good old days, they are counted as a BLS success story. Most families, if they tighten their belts and stretch their dollars, can live on 85% of their best-ever income.

The Callahan’s story reveals the underlying burden on our economy. The Callahans have never recovered from hitting bottom four years ago in November 2008 – the middle of a three-month stretch when they had no money coming in except for unemployment. In fact, instead of earning $500K in the past five years, they have earned only $350K, or 70% of what they might have earned. The $150K deficit was offset by only $25,000 of unemployment insurance benefits.

With the $125K shortfall in the past five years, here’s their current situation:

1. They are downing in debt.

They are behind on their mortgage, utilities and credit cards. Their cards are maxed out; 95% of their credit card debt is for utilities, groceries, car repairs and other essential items. Creditors are hounding them. They can’t take advantage of the lowest mortgage rates in memory, nor can they refinance because of their poor credit rating. They can’t sell their house either, because they are upside down on their mortgage – its value has dropped 16% from its peak in 2007, according to the Federal Housing Finance Agency.

2. They aren’t buying durable goods.

They aren’t buying cars, appliances or flat-panel televisions. Their main form of entertainment is a 20-year old 27-inch TV. They rent one-dollar movies from Redbox on Friday evenings. Their old refrigerator with the broken icemaker might last another year. They don’t entertain except for family, so they haven’t remodeled their kitchens, bathrooms or family room.

3. They don’t have any disposable income.

They aren’t dining out, going on vacation, or stopping at Starbucks. Their main priority is keeping their three rapidly-growing children in clothes that fit. They cut corners wherever they can; Karin replaces her contacts lenses every three months instead of the recommended once per month. They are unable to give money to their church.

Underemployment: The Insidious Burden

This is the insidious burden that is holding the economic recovery down. The Bureau of Labor Statistics counts the Callahan family as a success, but they are barely getting by. Some politicians call this a ‘win’ – when it’s a draw at best. The bottom line is that the Callahans – like millions of other families – are not pumping fuel in the economic engine that drives our economy.

The latest report from the Bureau of Economic Analysis says our gross domestic product (GDP) slowed to an annualized rate of 1.3% in the second quarter, down from 2.0% in the first quarter of 2012. A growth rate below 2% isn’t enough to lower the unemployment rate. Consumer spending – which accounts for about 70% of our economic activity – is slowing too.

Real personal consumption expenditures increased 1.5% in the second quarter of 2012, compared with an increase of 2.4% in the first. Durable goods decreased 0.2% in the second, in contrast to an increase of 11.5% in the first. Nondurable goods increased 0.6% in the second, compared with an increase of 1.6% in the first quarter.

The Callahans are working, but their lack of spending prevents other Americans from getting back to work.

How many families are there like this? The Bureau of Labor Statistics, which is very good at measuring things, says this data is impossible to measure.

One measure that correlates to this decline is the real median household income. The U.S. Census Bureau has not released data for 2011 or 2012, but there have been studies by former Census bureau income experts who now work for Sentier Research. The Sentier data shows a $4,631 drop in real median household income – from $55,309 down to $50,678 – since December 2007. That’s an 8.4% drop.

The Callahans are fighting back. The challenges they have faced as a family have brought them closer together. Their marriage is stronger. Their kids are healthy and happy. Their oldest son started college a few weeks ago; his Hope Scholarship is a big help, and he’s commuting to school to cut down on expenses. There are no flowers in their beds, but there is hope in their hearts as they await the dawn of a brighter day.

– – – – –

*This story is a composite based on real families and comes from conversations with my clients. The names and details in the story are fictitious.